Staying Current with ESG

Kenny Hung AIA, LEED AP BD+C, WELL AP, Fitwel Amb

Reema Nagpal LEED AP BD+C, WELL AP, Fitwel Amb

Why California's ESG Regulations are an Urgent Reality for Real Estate Asset Managers

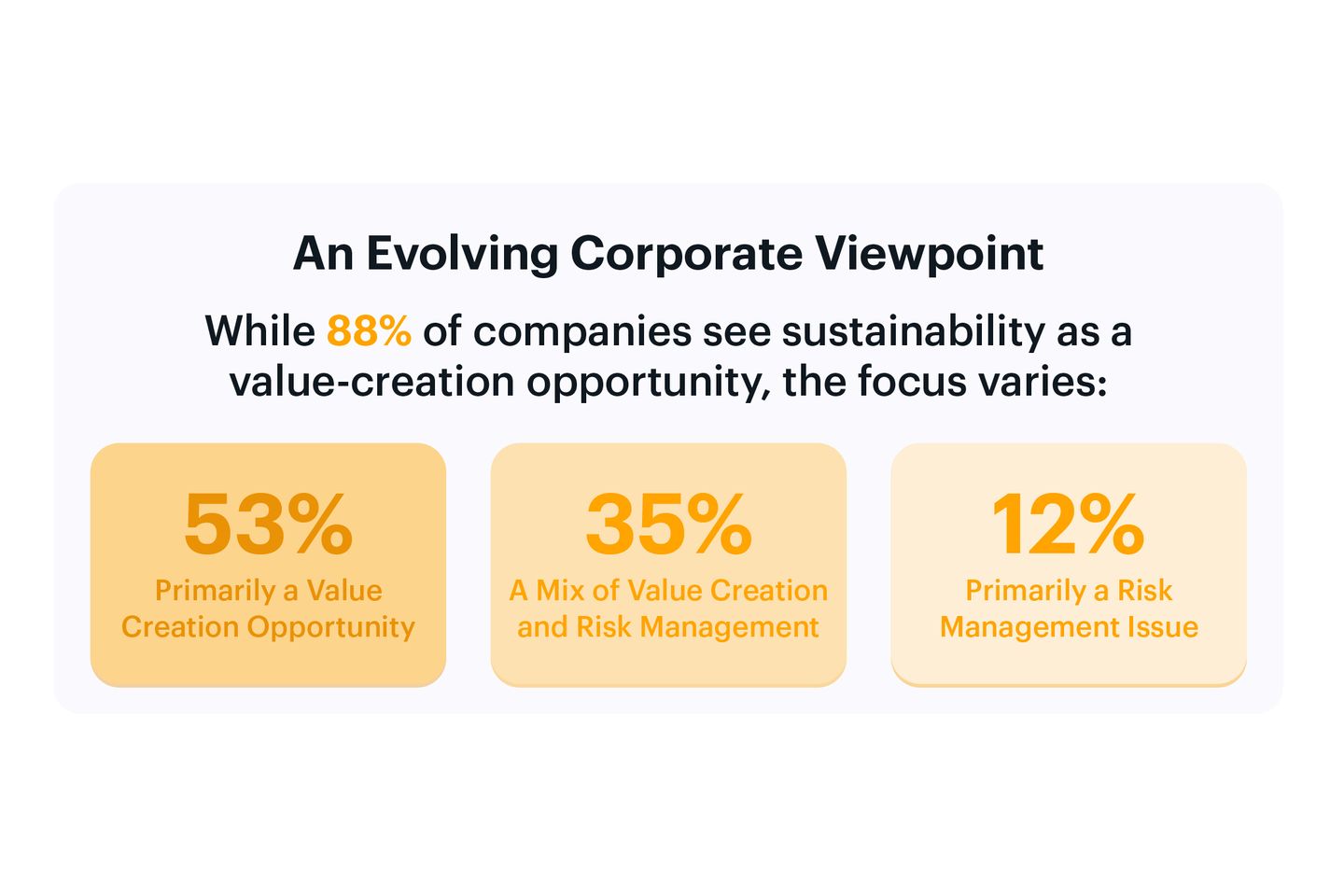

While the conversation around sustainability in the United States can seem complex, a definitive global trend is emerging that clarifies the path forward. Businesses around the world are increasingly moving beyond seeing sustainability as a challenge and are instead harnessing it as a core business driver. Clear evidence of this pivot comes from a recent Morgan Stanley survey, “Sustainable Signals”. The study found that a remarkable 88% of global companies now view sustainability as an opportunity to create value within their long-term strategy. This represents a significant increase from the previous year, highlighting a quick shift in perspective.

The data shows a decisive pivot. Only 12% of executives still hold the outdated view of sustainability as purely a risk management issue.

Nowhere is this shift from strategic choice to regulatory imperative more apparent than in California. The state is proving that ambitious climate action is achievable and is codifying this global sentiment into law. For years, ESG in California has been evolving from a niche interest for institutional players into a mainstream market driver. With foundational legislation like Senate Bills 253 and 261 now on the books, the landscape has fundamentally shifted. The conversation is no longer about if these regulations will have an impact, but how asset managers must adapt to a complex web of requirements with compliance deadlines beginning in less than 6 months—on January 1, 2026.

For California real estate and asset managers, this isn’t a future trend; it’s an immediate strategic challenge. A convergence of state, regional, and building-level mandates has created a new operational reality where ESG performance is inextricably linked to financial viability, risk management, and asset value.

The Climate Disclosure Mandates: SB 253 & SB 261

These twin bills represent the most significant corporate climate disclosure requirements in the United States, directly impacting large entities doing business in the state.

SB 253 (Climate Corporate Data Accountability Act)

What It Is: SB 253 requires public and private companies with over $1 billion in revenue doing business in California to report their full greenhouse gas footprint annually, following the widely used GHG (Greenhouse Gas) Protocol.

What It Means for Asset Managers: The compliance clock starts ticking in 2026 for 2025 data. This isn’t just about the energy buildings use (Scope 1 & 2). Crucially, it includes Scope 3 emissions, covering everything from construction materials to tenant energy consumption. Asset managers will need robust data infrastructure to collect, manage, and verify this information across their value chain, an undertaking that must begin now.

SB 261 (Climate-Related Financial Risk Act)

What It Is: SB 261 requires companies with over $500 million in revenue to produce a biennial report on their climate-related financial risks, aligned with the Task Force on Climate-related Financial Disclosures (TCFD) framework.

What It Means for Asset Managers: The first report is due by January 1, 2026. This moves climate change from an environmental issue to a core financial risk management function.

For SB 261, you must assess and disclose:

Physical Risks: How will wildfires, sea-level rise, or extreme heat impact your property values, insurance costs, and operations?

Transition Risks: How will the shift to a low-carbon economy—through building codes, carbon pricing, or market demand for green buildings—affect your assets’ profitability and potential for obsolescence?

While it’s important to know these laws are facing a legal challenge, they currently remain in effect, and the state is moving forward with implementation. The California Air Resources Board (CARB) is finalizing the specific rules and has proposed a June 30, 2026, deadline for the first emissions reports under SB 253. Additionally, CARB has indicated it will exercise enforcement discretion during the first reporting year, focusing on good-faith efforts rather than penalties. Given this, the clear and advisable path for businesses is to continue preparing to meet the upcoming deadlines.

An Action Plan for California Asset Managers

The time to prepare is now and here is how you can start:

- Conduct a Portfolio-Wide Gap Analysis: Assess your portfolio against the requirements of SB 253/261. Do you meet the revenue thresholds? Where are your biggest data gaps for GHG and climate risk reporting?

- Integrate ESG into Due Diligence: Your acquisition checklist must now include a TCFD-aligned climate risk assessment (wildfire, flood, transition risk), Title 24/CALGreen compliance verification, and a review of local regulations.

- Build Your Data Infrastructure: You cannot manage what you do not measure. Implement systems to track energy, water, waste, and tenants and supply chain data needed for Scope 3 reporting. Align your internal reporting with GRESB and TCFD to meet investor expectations and prepare for mandatory disclosures.

- Engage Your Tenants: Data collection requires partnership. Use lease provisions to facilitate the sharing of utility data necessary for whole-building performance tracking and emissions reporting.

The Road Ahead: What's Next?

The current regulations are not the destination. The CARB 2022 Scoping Plan sets a clear path toward carbon neutrality by 2045, signaling a continued push for electrification and deep retrofits of existing buildings. So, for real estate asset managers in California, ESG has completed its transition from nice-to-have to non-negotiable. Proactively managing this complex regulatory environment is now fundamental to mitigating risk, preserving asset value, and seizing the competitive advantage.

Recently completed, Southline, which is certified LEED Gold and Fitwel 2 Star, supports the ESG goals of our client while providing new public outdoor spaces and amenities for the community.